A comprehensive finance course that teaches you how to operate like an analyst before you get the interview

50% off for limited time

$1000+ course for only $499

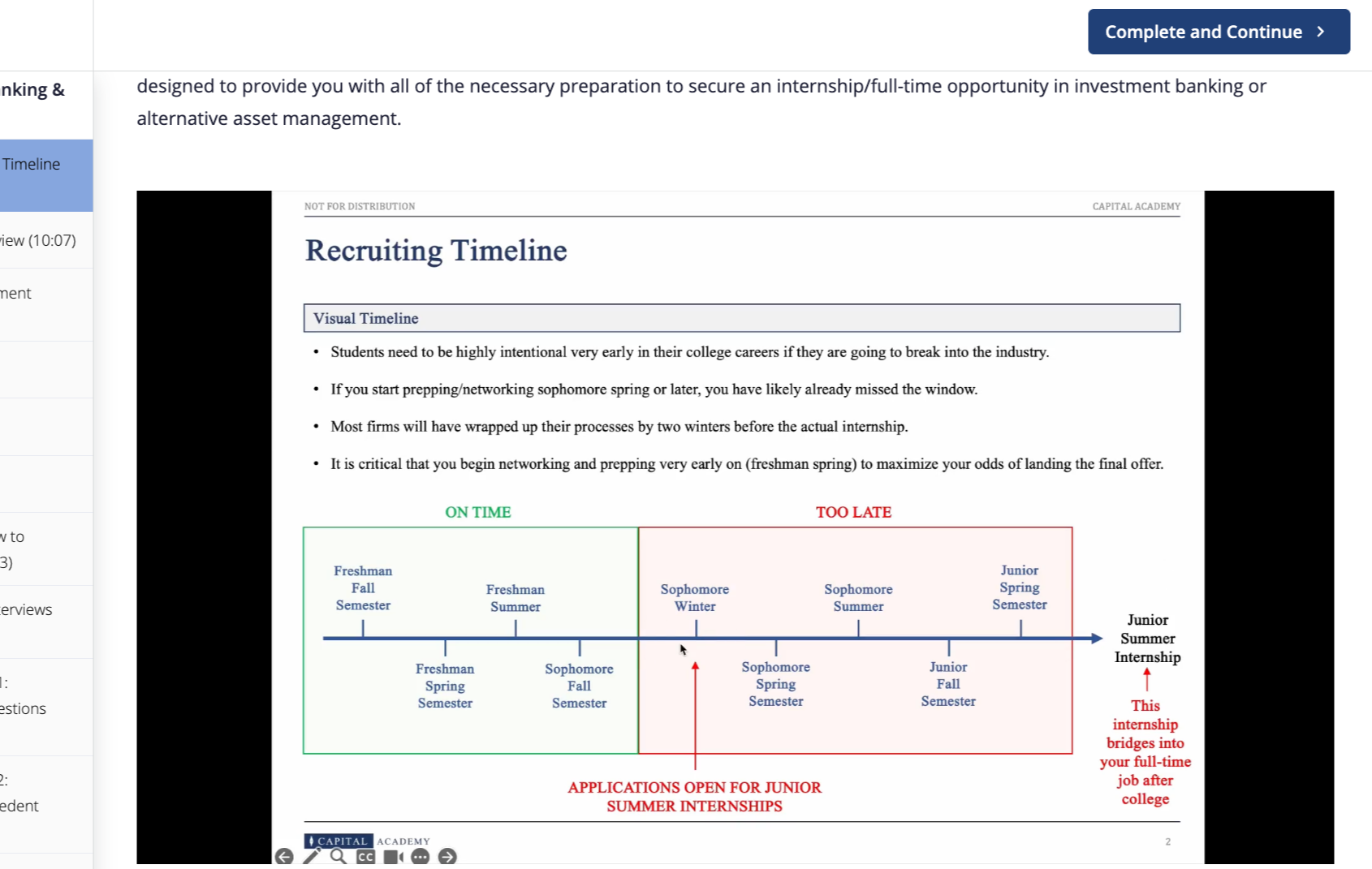

Accelerated Wall Street job recruiting, coupled with minimal practical preparation resources, leaves students and young professionals disadvantaged, especially those who attended non-target schools.

Built for students and young professionals pursuing a career in high finance, Capital Academy is a comprehensive, hands-on, and self-paced financial modeling and recruitment course designed to equip aspiring analysts with the technical expertise and strategic thinking required to excel in investment banking and alternative asset management (private equity and private debt).

Unlike broad and foundational-level courses that lack industry-standard instruction, Capital Academy offers an "On-The-Desk" approach that mirrors the real-world demands of a transaction, incorporating both buy-side and sell-side perspectives. Capital Academy teaches students how to operate at the same level as analysts in the industry.

Whether you are a college freshman just learning the fundamentals, a senior preparing to start your full-time job, or a young professional preparing to pivot into a role in high finance, Capital Academy provides instruction across the spectrum, from accounting and valuation to the advanced construction of industry-level deliverables.

At A Glance

Over 150 lessons across 9 modules that serve young professionals at all levels…

-

A comprehensive guide to recruiting for roles in investment banking and alternative asset management, breaking down the exact formula that has recently placed dozens of non-target students into the most sought-after roles on Wall Street.

-

Dedicated Excel and PowerPoint module designed to teach students and young professionals how to master Microsoft Office, tailored for advanced modeling and PowerPoint creation for roles in investment banking and alternative asset management.

-

Outlines the core financial accounting principles essential for the industry, laying the groundwork for Capital Academy’s financial modeling course.

-

An introductory financial modeling course that covers the key components of the operating model, along with supporting schedules through a real-world case study.

-

Builds on core accounting and financial modeling foundations by introducing relative and intrinsic valuation techniques along with professional presentation.

-

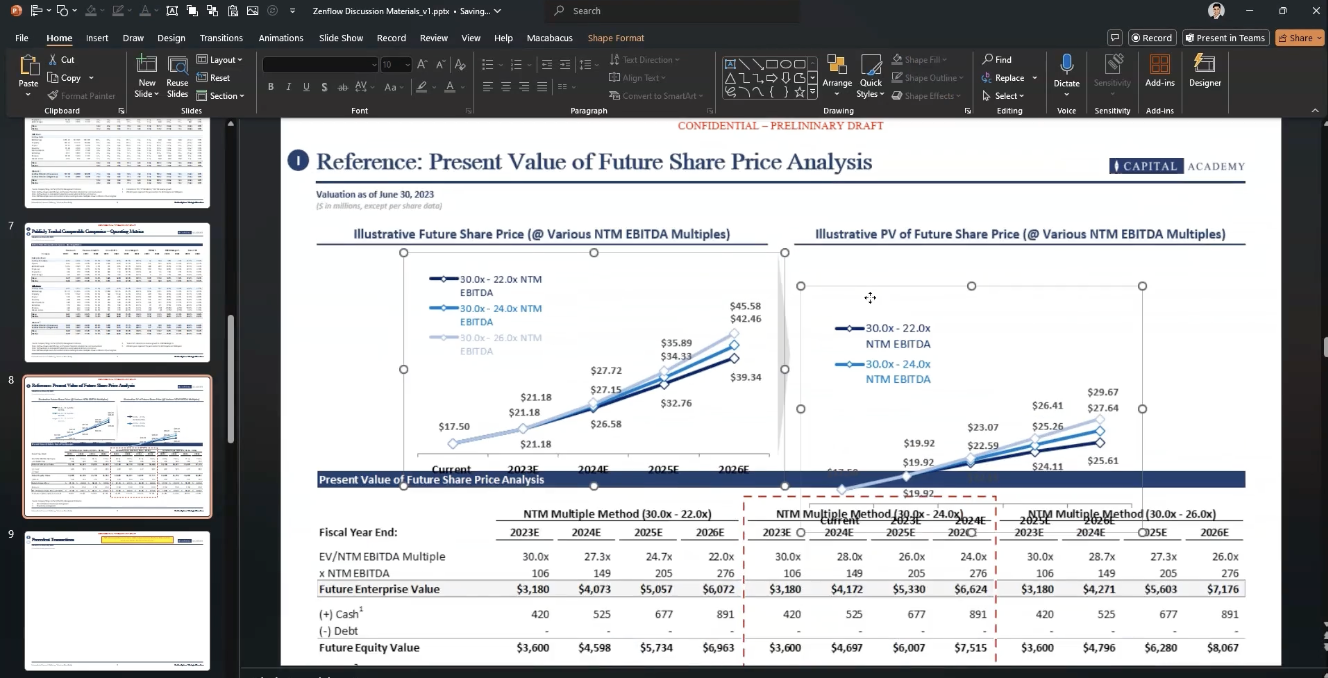

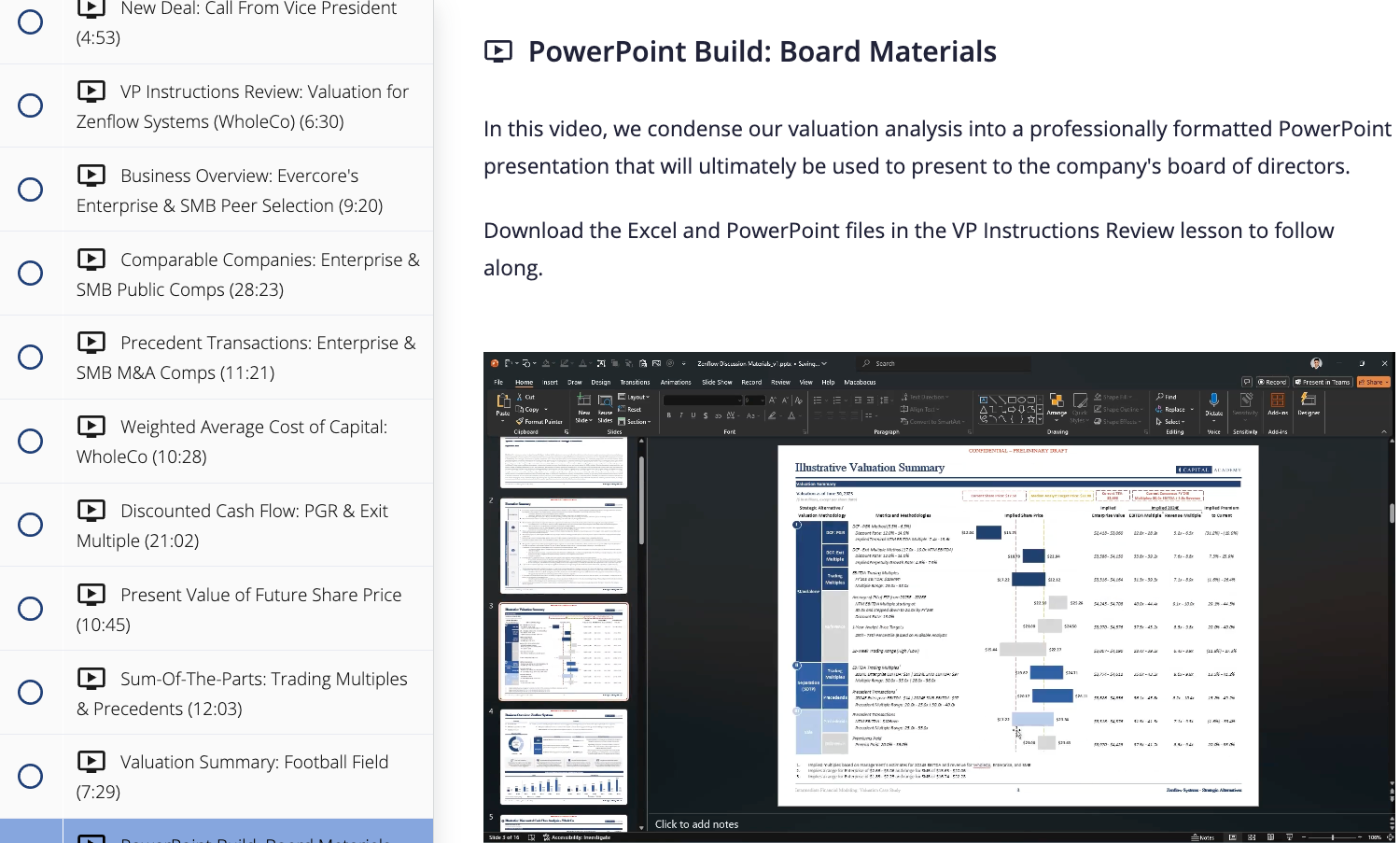

Full case study that simulates the role of an investment banking analyst, preparing board materials relating to strategic alternatives for an integrated payments business.

Students construct an advanced valuation analysis for a vertically integrated payment solutions business and prepares an industry-level board presentation.

-

Provides quick tips and Excel functionalities that all analysts should be familiar with and understand how to layer into any model.

-

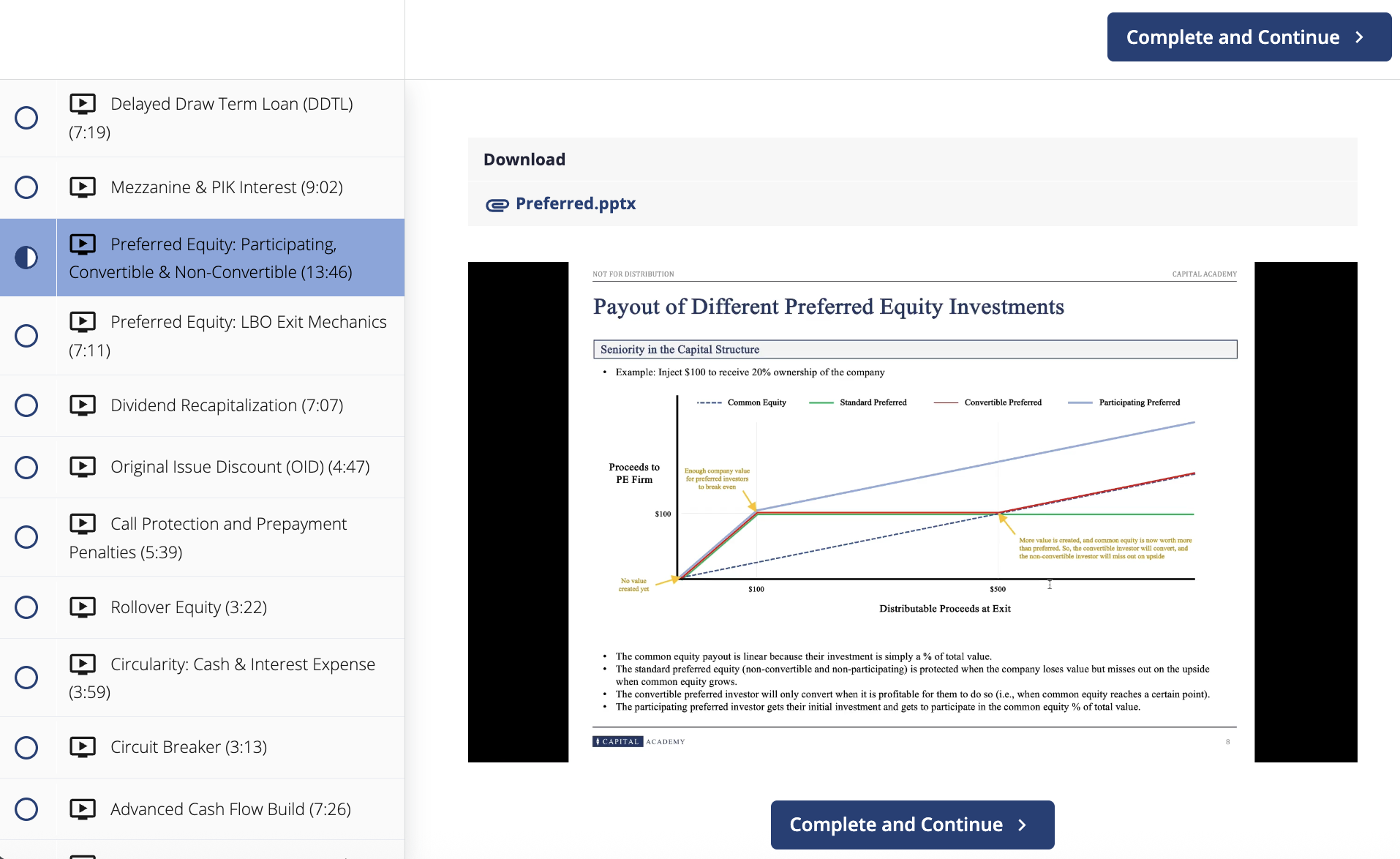

Highly diverse modeling and concepts module designed to expose young professionals to advanced finance concepts, along with an introduction to how these concepts appear in a model.

-

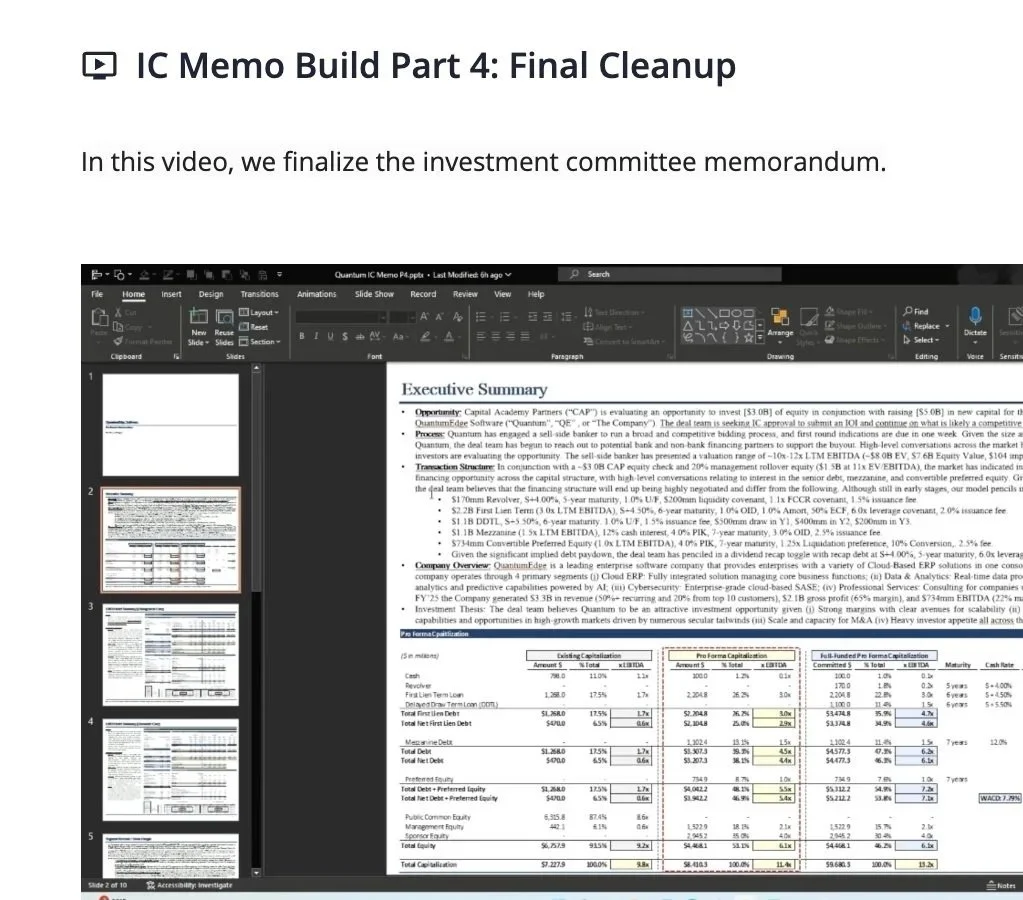

Combine every single concept, Excel mechanic, and PowerPoint skill covered throughout the course to construct a full, comprehensive investment model from scratch.

Prepare a pre-screen IC memorandum that summarizes a detailed thesis to ultimately present to the investment committee.

Foundational and advanced modeling concepts that not only help our students land top finance jobs but also outperform peers once on the job

Master Excel & PowerPoint

Completely master Microsoft Office with access to our dedicated Excel and PowerPoint module, teaching young professionals how to use it in the same way as an industry professional.

Advanced Finance Concepts

Access our diverse range of advanced finance and modeling concepts, which are applied every day in investment banking and alternative asset management. Build on the core foundations and learn associate-level concepts.

Analyst-Level Case Studies

Work through real, advanced case studies that place you in the analyst’s seat. Whether you're building valuation and board materials as an investment banking analyst or drafting an investment committee memo in private equity, this course equips you with the skills to think and operate like an analyst before you even land the interview.

Recruiting

Gain full access to the exact recruiting framework that students at non-target schools have used to consistently secure internships and full-time job opportunities at some of the elite investment banks and investment managers in the world.

Secure the “Capital Academy Analyst Certification”

Communicate your technical skill set, industry knowledge, XLX/PPT proficiency, and ability to operate like a full-time analyst to potential employers

Start Your Career in Finance Today

Join the top cohort of young professionals and Capital Academy alumni on Wall Street

50% off for limited time

$1000+ course for only $499

If you have questions or concerns before you enroll, email us to set up a call!